Five Key Drivers of Nature Loss have the Potential to Cost Companies and Investors up to $430 Billion per Year

A report by non-profit sustainability organization Ceres – building on economic analysis by Cambridge Econometrics – provides novel insights on the financial impact of nature loss for eight global industry sectors. It recommends four key areas of actions for affected companies and investors to help manage the associated financial risk.

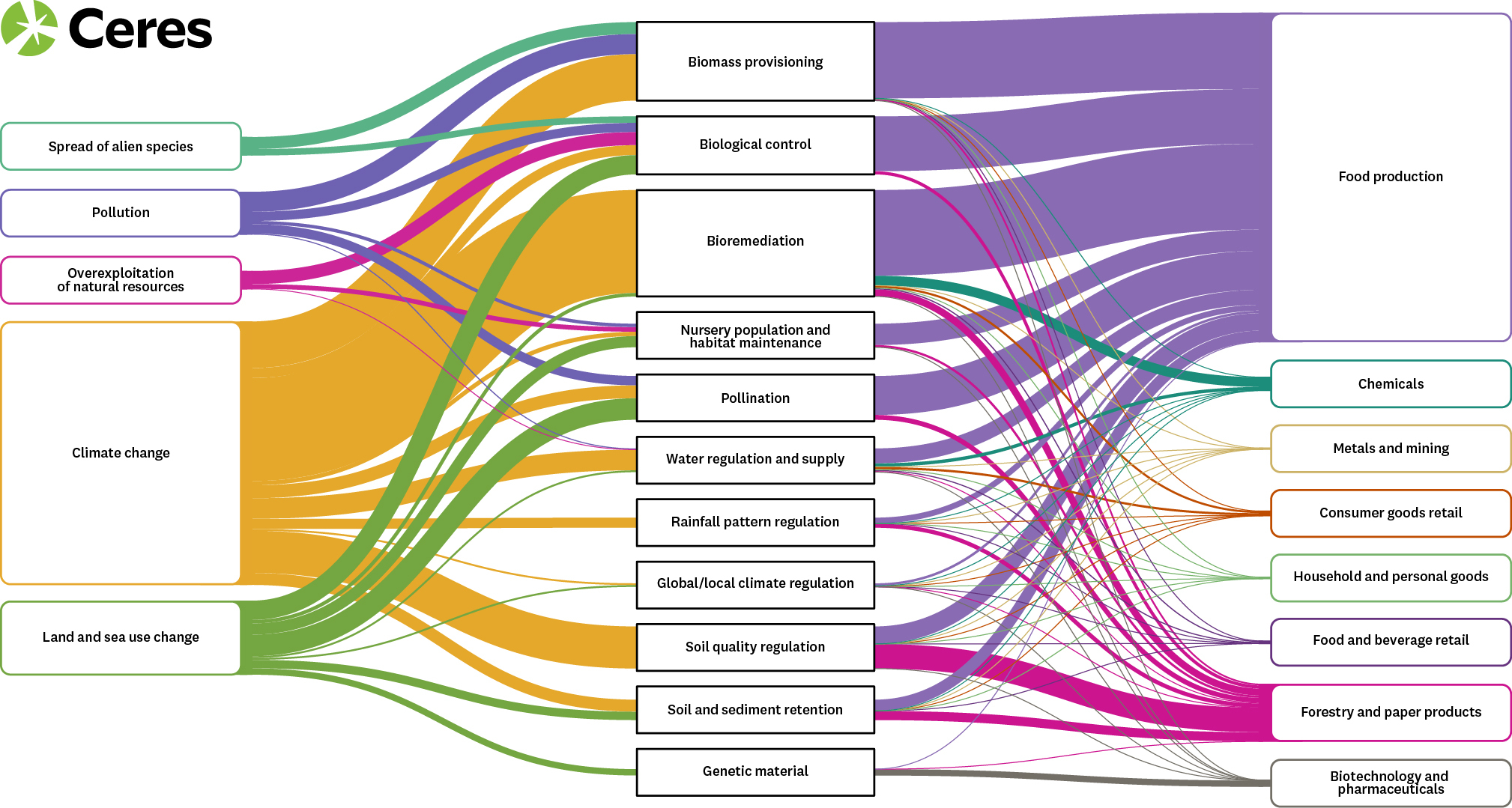

Left unchecked, the cumulative cost of five key drivers of nature loss – the spread of alien species, pollution, overexploitation of natural resources, climate change and change in land and sea use – could amount to $2.15 trillion over five years for all eight sectors.

Image source: 'Nature's Price Tag: The economic cost of nature loss', Ceres, September 2025

Report findings show that of the key drivers of nature loss, climate change has the potential to cause the greatest economic impact through the degradation of ecosystem services which the eight sectors rely on. And of the eight sectors, the food sector was revealed as facing the largest annual cost of $253 billion if damage to natural ecosystems continues unchecked.

By calculating the costs of inaction, our report shows for the first time the staggering financial risks of escalating nature loss to major sectors of the global economy. Ceres’ findings deliver companies and their investors a clear and compelling business case for addressing nature risk and building resilience now to prevent paying more for operational and supply chain disruptions, legal fees, and regulatory compliance later on.

Program Director for Food and Forests, Ceres

Cambridge Econometrics supported the analysis by quantifying the economic contribution of nature and ecosystem services to the functioning of sectors , assessing the economic costs of the degradation of these ecosystem services in a business-as-usual scenario where the drivers of nature loss continue with no efforts taken to manage them.

Quantifying the contribution of ecosystem services to key industry sectors provides critical insight into the interdependencies between the natural world and economic systems. This research highlights the need to address nature in business and financial decision-making and accelerate the transition to a resilient, sustainable economy.

Principal Economist - Natural Resources Lead, Cambridge Econometrics

The report develops an investor engagement framework to provide practical tools for financial institutions to assess their exposure to the financial impact of nature loss and to engage portfolio companies to build resilience by reducing their nature-related risks.

Contact Us